Of course owners still need to obtain the appropriate business licenses and permits tax identification numbers and may need to register the business name. The exclusive difference between being a sole proprietor vs individual business owner is the taxation process.

Chapter 4 Forms Of Business Ownership Introduction To Business

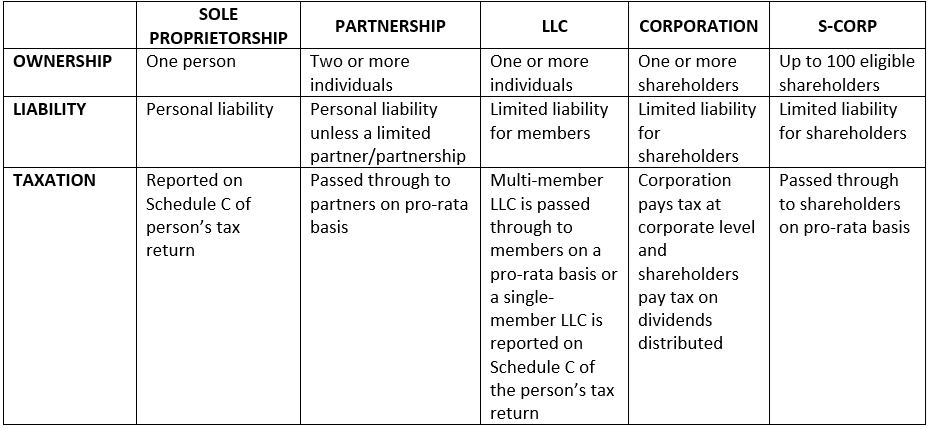

Single-member LLC vs sole proprietorship.

. This means that the owner is still liable for the businesss debts losses and legal obligations. There are many types of business formation one can choose. Trustees governing bodies or committee members.

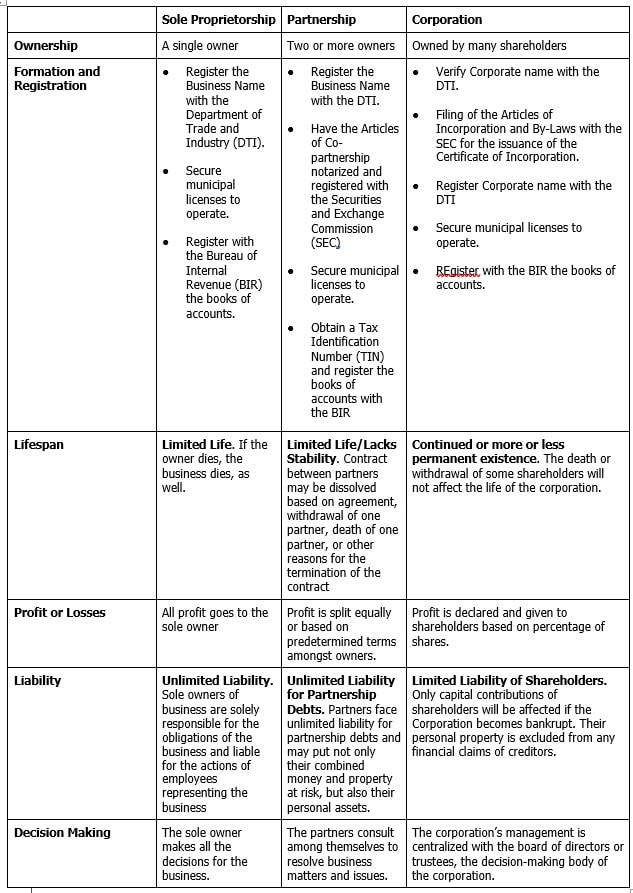

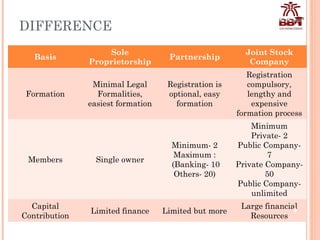

Sole proprietorship person fizik A business owned and managed by one individual who is personally liable for all business debts and obligations. Estimating the time it takes to get a divorce includes factors such as where you live if your state has a cooling off period or required period of. A company may be incorporated in a variety of ways including Statutory Companies Single Person Company Companies Limited by shares a company limited by.

You do not need to file any particular tax forms with the state or federal government for a sole proprietorship. Hence there are some benefits of having a proprietorship. Bid Price vs Ask Price.

That alone establishes you as a sole proprietorship. The sole proprietorship is the simplest form of organization and the least expensive to start. A subordinate to the MoA.

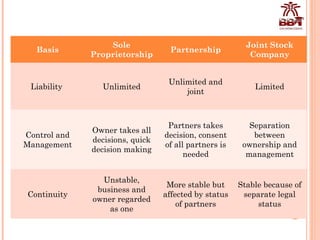

Stock vs Inventory. A dominant document that helps drafting AoA. For a partnership the owners of the organization are purely responsible for the liabilities of the organization.

As the default business formation sole proprietorships make up the vast majority of small businesses that dont have employees 866 of non-employers are sole proprietorships. Another difference between a company and a partnership is the issue of liability. Basically you just go into business.

Difference Between Accrual vs Provision. A sole proprietorship and single-member LLC are both businesses owned by one person. This has been a guide to the top difference between Graphs vs Charts.

In case of the dissolution of the partnership the properties of the partner members will be taken to pay for the liabilities of the partnership to. LLP stands for Limited Liability Partnership. The sole proprietorship tax advantages are simplified reporting requirements and not paying separate taxes for the business.

The members of the firm are bound by the Partnership Deed and no member can take a sole decision without consulting the other partners. As your small. However unlike a limited liability company a sole proprietorship is not legally separated from its owner.

Filing at the time of company registration. Business owners sole proprietors or partners. It makes sense to start a business by knowing the merits and demerits of the various types of business.

The organizations that are of nonprofit types are clubs trusts society etc. You may also have a look at the following articles to learn more. The organization can be a company partnership or sole proprietorship firm.

A supreme legal document for company and subordinate to Companies Act. Sole proprietorship firms are considered individuals owning businesses. Filing at the time of company registration is optional.

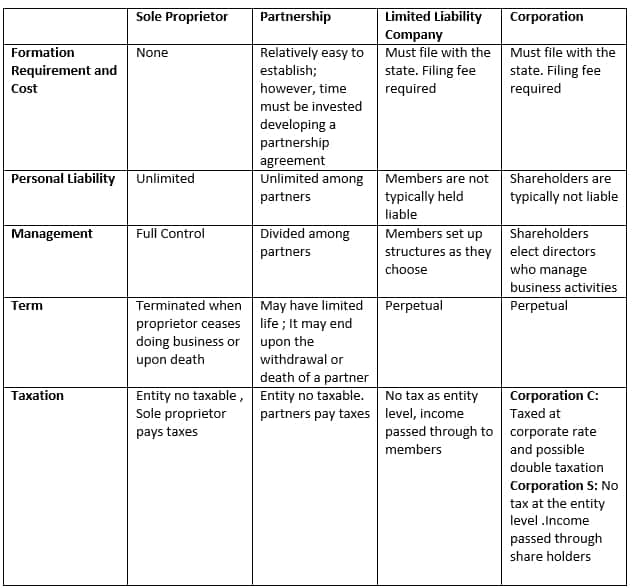

A sole proprietor is also known as a sole trader individual entrepreneur and various other names. Limited liability company LLC A hybrid legal structure that provides the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. Can opt for Table A instead of AoA in public limited company by shares.

Sole proprietorship refers to a business where there is no distinction between the owner and the business entity. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more. Day Trading vs Swing Trading.

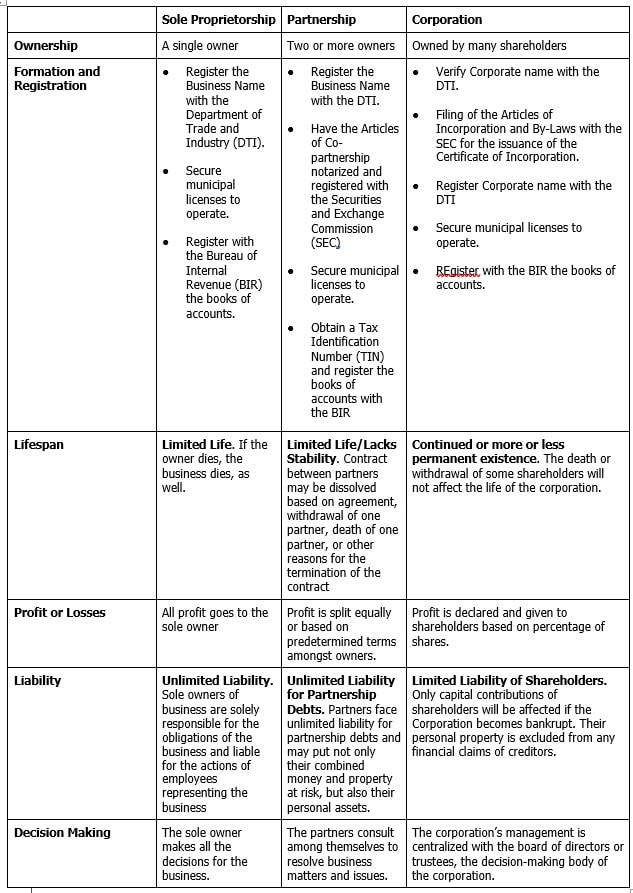

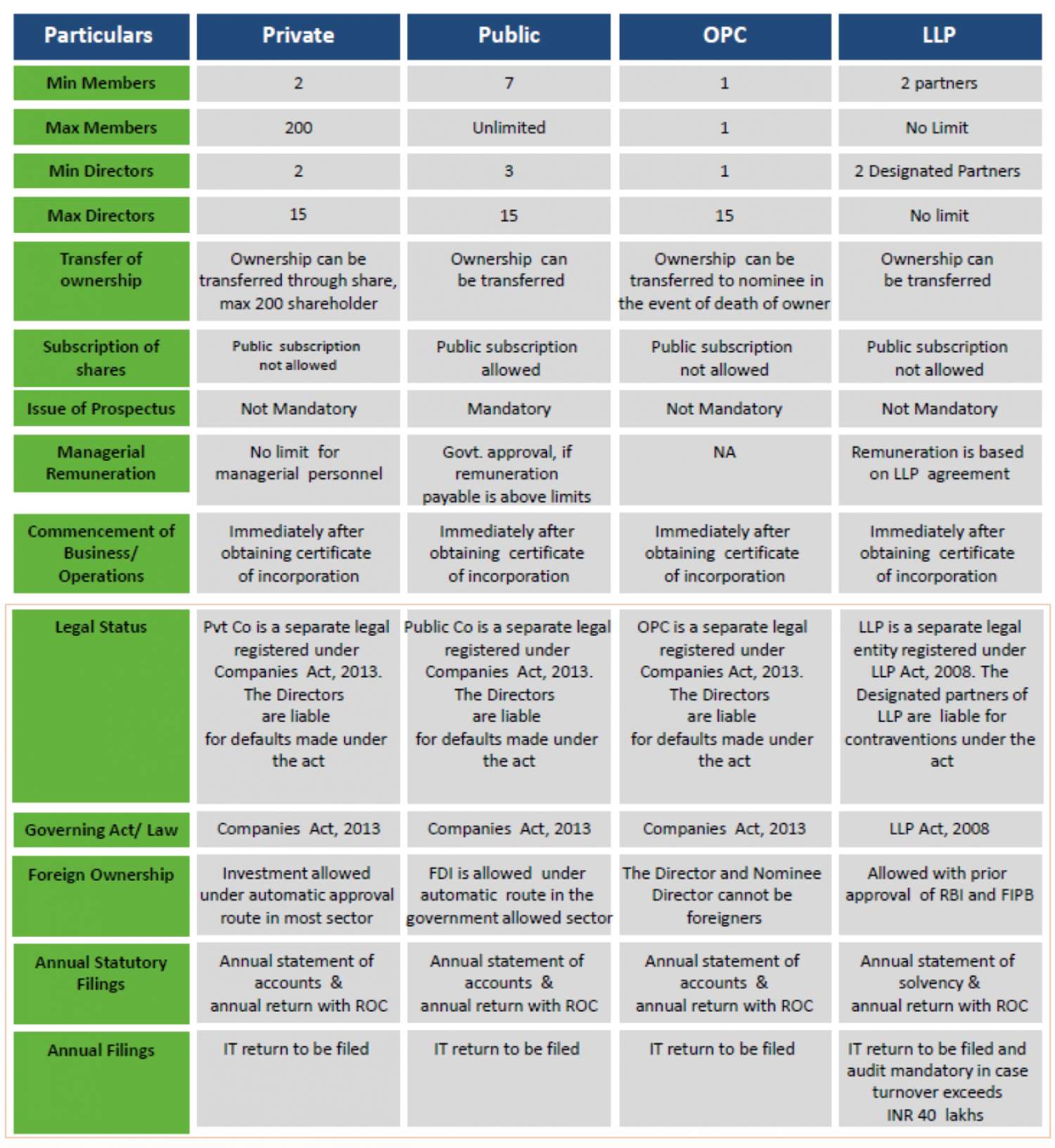

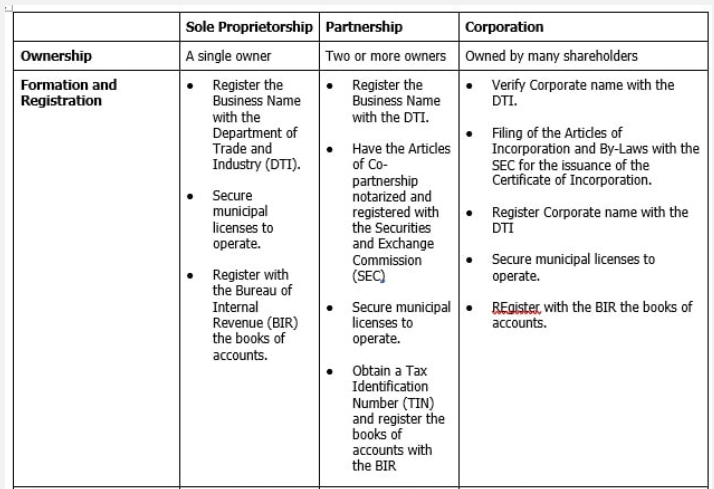

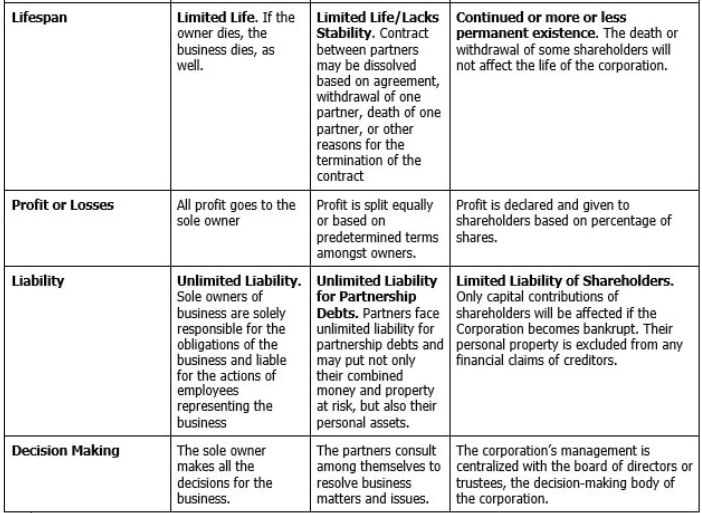

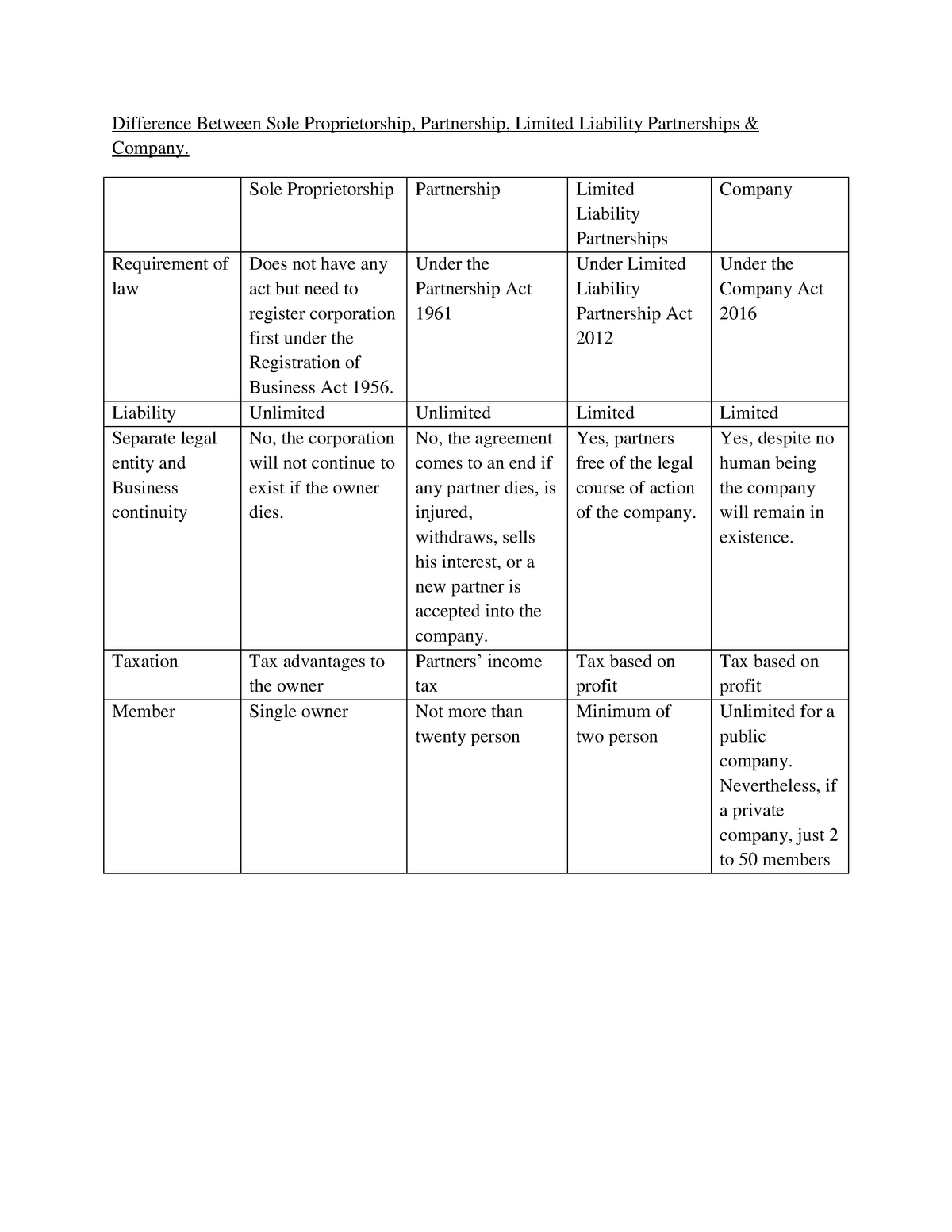

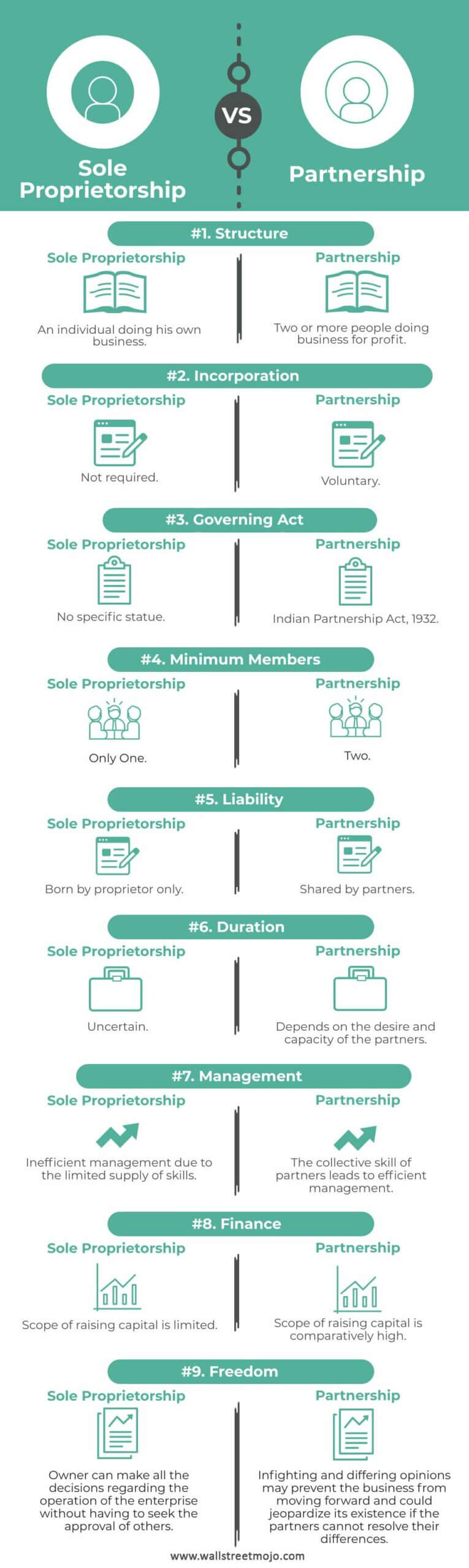

Difference between Public Company vs Private Company The company is an association of people who have the desire to engage in certain business activities while maintaining a legal presence. The following table will highlight the most critical points of difference between the types of business entities namely sole proprietorship and partnership. Some of the most popular formats are a sole proprietorship partnership LLP Joint-Stock Company etc.

Here we also discuss the Graphs vs Charts key differences with infographics and comparison table.

Chapter 4 Forms Of Business Ownership Introduction To Business

Which Entity Should I Form When Starting A New Business

Comparative Feature Of Different Type Of Business Entity

Forming A Partnership Lexology

Types Of Business Ownerships In India Ithink Logistics

Forming A Partnership Lawyers In The Philippines

Difference Between Sole Proprietorship Partnership Joint Stock Com

Difference Between Sole Proprietorship Partnership Joint Stock Com

Forming A Partnership Lexology

Chapter 4 Forms Of Business Ownership Introduction To Business

Choosing The Right Legal Structure For Your Business Considerations For Start Up Businesses

Types Of Business Entities Comparison Chart Mycorporation

Difference Between Sole Proprietorship Partnership Joint Stock Com

Learn About Proprietorship Chegg Com

Difference Between Sole Proprietorship Partnership Joint Stock Com

Difference Between Sole Proprietorship Partnership Limited Liability Partnerships Company Studocu

Sole Proprietorship Vs Partnership Top 9 Differences With Infographics

Difference Between Partnership Firm And Company With Comparison Chart Key Differences